What And How Do You Deal With Divergence Using A Technical Indicator?

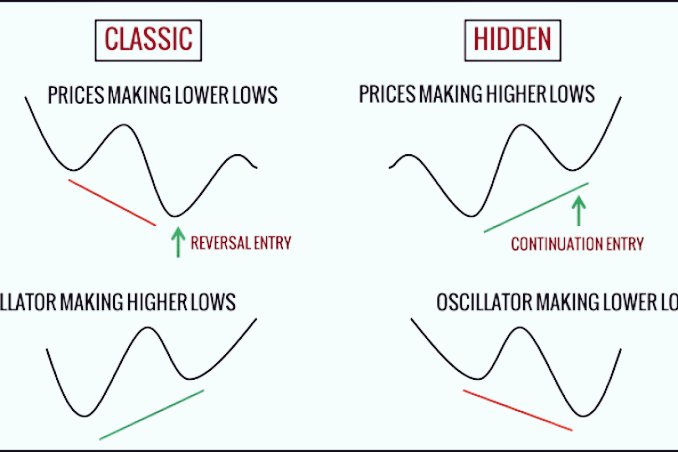

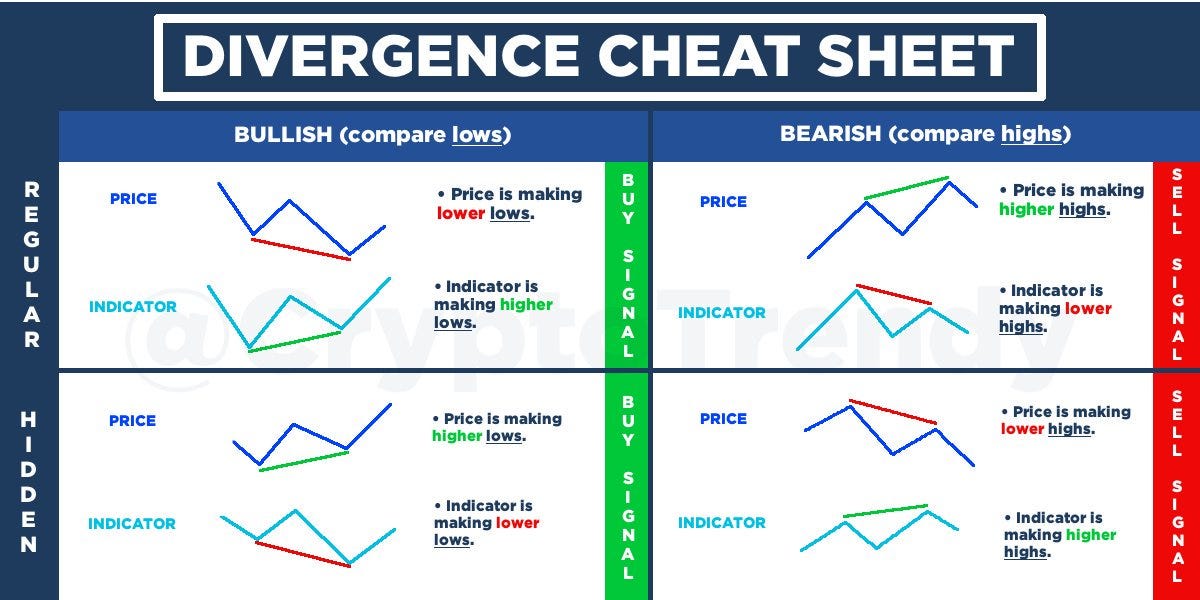

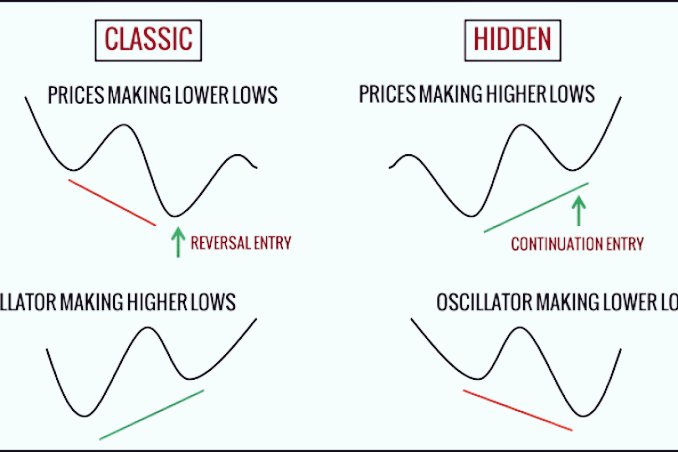

Divergence is a technique that's utilized to analyse trends in the technical world. It's when the direction of a certain kind of oscillator or technical indicator diverges from general price trends. In this case the indicator is going in the opposite direction of the price, and the trading oscillator signals the possibility of a trend reversal.

How Does Divergence Affect Trading?

Day traders use the indicator for change in direction to indicate that price may shortly follow. In this situation, the oscillator is used to show the price. Divergence is utilized to study the market price because it indicates a decrease of momentum. The price's momentum changes often before the price. It's similar to throwing a frisbee against a strong wind. After a while the frisbee will begin to move against the wind, but then it will slow down. Finally, it will change direction and fly with the wind. See the most popular

trading with divergence for site info including bitcoin app download apkpure, 0 bitcoin, good crypto app review, crypto app south africa, bitcoin app real, crypto app 2021, crypto app guide, bitcoin app that accept wire transfer, zerion crypto app, vault crypto app, and more.

Which One Of These Indicators Is The Most Reliable Indicator Of The Divergence?

Which One Of These Indicators Is The Most Reliable Indicator Of The Divergence?

There isn't a single indicator that is the best for trading divergence. Every technical indicator has its advantages and disadvantages. We will look at the three most widely used indicators: RSI, MACD & Stochastic.

Rsi To Detect Divergence In Trading

The RSI indicator (or momentum indicator) is plotted beneath the candlestick chart to show an oscillator. This indicator is also called an underlay indicator. The RSI indicator is calculated by adding up the gains and losses in price of the 14 preceding periods. J. Welles Wilder Jr. invented it in his book "New Concepts In Technical Trading Systems." It creates a smooth line which tends to follow the price trend and is a good indicator for trading with divergence. The default setting of RSI is 14 times. It gives very few indications that are too overbought, or too sold. This means that there are less signals when divergence is used as a signal for trading, but they are more reliable. Read the most popular

cryptocurrency trading for site recommendations including bitcoin app that works in canada, mxc crypto app, top 5 crypto mining apps, is the bitcoin app real, crypto app kokemuksia, upload bitcoin app, bitcoin app guide, xt crypto app, crypto.com app not available in your region, luna crypto app, and more.

MACD for divergence trading

MACD is a momentum indicator that is best utilized when tracking trends. The trend indicator plots both the signal line as well as a histogram to show the differences between two moving averages. As the trend continues to progress the moving averages will converge and diverge. The trend then reverses. Although the visual representation of the histogram can be useful to understand trading divergence, it is more difficult to comprehend once a new'swingpoint' has been established. It's difficult to determine what trends are reliable as there isn't a single area which is defined as overbought/oversold in MACD. This can be overcome by using previous peaks on the MACD in order to use them as areas of resistance and support. Since it's best utilized in trending environments The MACD will produce many false signals in opposition to the trend.

Stochastic For Trading Divergence

Stochastic functions as a momentum technical indicator by comparing its closing price to an average over the past 14 time periods. The stochastic indicator is more sensitive, which means it offers greater trading opportunities as well as divergence signals. However, this means it is able to provide more false signals. View the best

best trading platform for website tips including robinhood crypto app uk, can you buy crypto on cash app, crypto app template, best crypto app for xrp, cryptocurrency app design, pi bitcoin app, 8 crypto, 0 brokerage crypto trading app, paxful bitcoin app, crypto app 2fa not working, and more.

How Do You Confirm Divergence?

How Do You Confirm Divergence?

Yes, but it is not always the case! Remember that indicators are used to filter price actions. The filter can allow us to identify what's important or overlook what's crucial in the context of the trading setup. The major advantage of using divergence as a trading signal for timing a trade entry is that it provides an indication before the price trend has changed. This signal comes before the market has changed and provides traders with a lower entry cost. There are a few disadvantages the use of divergence as a trading technique. It can produce false signals. This is where the indicator's direction changes but the trend of the price doesn't reverse, like the name suggests. This can happen when the indicator is overbought or oversold. While the pace of the trend could slow but it won't stop.

How Can You Determine If Divergence Is Present?

There are numerous proven strategies to lower the chance of losing trades and increase the probability of making money from trades. Avoid taking divergence signals that aren't in accordance with the trend of the long-term. If you prefer, you can go for the rangebound sideways. In the case of a bear market, you should only take signals that are bearish on RSI. In a bull market, however it is best to only accept signals to buy from RSI. Watch for the candle to confirm the divergence signal to close. Indicators will give signals based on the present status of the candle. The signals of divergence may disappear as quickly as they appear when the candle closes with a different outcome. Other indicators can be used to verify the signal. They include pivot points round numbers, pivot points and price action trading patterns. You can then choose RSI or MACD from the options. After the indicator is added to the chart, you can alter its settings. To take it off you need to click on the Arrow to change the indicator from active to none. Check out the top rated

bot for crypto trading for blog examples including how to earn free bitcoin app, kraken crypto app review, cash app bitcoin scams 2022, download crypto app, cash app bitcoin fees 2021, crypto app for windows 10, crypto app vs coinbase, crypto app singapore, bitcoin app 360 ai tesla, crypto app builder, and more.

What is the time when RSI Divergence fail?

What is the time when RSI Divergence fail?

Like all trading strategies, divergence might not be 100% effective. When markets are in a high trend, the most frequent place that divergence fails is. Trading in strong trending markets can lead to big losses. This is why you should ensure you have a clearly defined money-management strategy in place. To limit your losses, learn to know when you're in the direction of a trend. Your exit strategy along with your execution performance and your ability analyze the trades objectively are all elements which affect your win rate. Lack of testing, giving up too early and not properly recording trades or using a trading strategy that fails to gain an advantage, having unrealistic expectations, not understanding the anticipated statistics, and not recognizing good trading opportunities are the primary causes of the failure of a trading system. These are all issues that could be due to the way you approach trading. If you are employing a strategy for trading that is winning and your losing streak continues you need to look into your mindset and your trading strategy. Do not alter your approach just because you're experiencing a losing streak. The problem might not be related to your method. Take a look at your trading strategies independently. View the recommended

trading divergences for blog examples including free crypto app, rsi crypto app, crypto app japan, crypto app 2fa greyed out, can i buy bitcoin on zelle app, crypto app contact number, bitcoin app cash out, user friendly crypto app, bitcoin app for bangladesh, crypto app new york, and more.

What Should I Do If I Want To Trade In Divergence

In conclusion trading divergence could be beneficial to your trading plan, especially in the event that you are already using indicators such as RSI or MACD to determine overbought or oversold levels. However, it shouldn't be a response on its own and requires practise to get it right.

Which One Of These Indicators Is The Most Reliable Indicator Of The Divergence?

There isn't a single indicator that is the best for trading divergence. Every technical indicator has its advantages and disadvantages. We will look at the three most widely used indicators: RSI, MACD & Stochastic.

Rsi To Detect Divergence In Trading

The RSI indicator (or momentum indicator) is plotted beneath the candlestick chart to show an oscillator. This indicator is also called an underlay indicator. The RSI indicator is calculated by adding up the gains and losses in price of the 14 preceding periods. J. Welles Wilder Jr. invented it in his book "New Concepts In Technical Trading Systems." It creates a smooth line which tends to follow the price trend and is a good indicator for trading with divergence. The default setting of RSI is 14 times. It gives very few indications that are too overbought, or too sold. This means that there are less signals when divergence is used as a signal for trading, but they are more reliable. Read the most popular cryptocurrency trading for site recommendations including bitcoin app that works in canada, mxc crypto app, top 5 crypto mining apps, is the bitcoin app real, crypto app kokemuksia, upload bitcoin app, bitcoin app guide, xt crypto app, crypto.com app not available in your region, luna crypto app, and more.

MACD for divergence trading

MACD is a momentum indicator that is best utilized when tracking trends. The trend indicator plots both the signal line as well as a histogram to show the differences between two moving averages. As the trend continues to progress the moving averages will converge and diverge. The trend then reverses. Although the visual representation of the histogram can be useful to understand trading divergence, it is more difficult to comprehend once a new'swingpoint' has been established. It's difficult to determine what trends are reliable as there isn't a single area which is defined as overbought/oversold in MACD. This can be overcome by using previous peaks on the MACD in order to use them as areas of resistance and support. Since it's best utilized in trending environments The MACD will produce many false signals in opposition to the trend.

Stochastic For Trading Divergence

Stochastic functions as a momentum technical indicator by comparing its closing price to an average over the past 14 time periods. The stochastic indicator is more sensitive, which means it offers greater trading opportunities as well as divergence signals. However, this means it is able to provide more false signals. View the best best trading platform for website tips including robinhood crypto app uk, can you buy crypto on cash app, crypto app template, best crypto app for xrp, cryptocurrency app design, pi bitcoin app, 8 crypto, 0 brokerage crypto trading app, paxful bitcoin app, crypto app 2fa not working, and more.

Which One Of These Indicators Is The Most Reliable Indicator Of The Divergence?

There isn't a single indicator that is the best for trading divergence. Every technical indicator has its advantages and disadvantages. We will look at the three most widely used indicators: RSI, MACD & Stochastic.

Rsi To Detect Divergence In Trading

The RSI indicator (or momentum indicator) is plotted beneath the candlestick chart to show an oscillator. This indicator is also called an underlay indicator. The RSI indicator is calculated by adding up the gains and losses in price of the 14 preceding periods. J. Welles Wilder Jr. invented it in his book "New Concepts In Technical Trading Systems." It creates a smooth line which tends to follow the price trend and is a good indicator for trading with divergence. The default setting of RSI is 14 times. It gives very few indications that are too overbought, or too sold. This means that there are less signals when divergence is used as a signal for trading, but they are more reliable. Read the most popular cryptocurrency trading for site recommendations including bitcoin app that works in canada, mxc crypto app, top 5 crypto mining apps, is the bitcoin app real, crypto app kokemuksia, upload bitcoin app, bitcoin app guide, xt crypto app, crypto.com app not available in your region, luna crypto app, and more.

MACD for divergence trading

MACD is a momentum indicator that is best utilized when tracking trends. The trend indicator plots both the signal line as well as a histogram to show the differences between two moving averages. As the trend continues to progress the moving averages will converge and diverge. The trend then reverses. Although the visual representation of the histogram can be useful to understand trading divergence, it is more difficult to comprehend once a new'swingpoint' has been established. It's difficult to determine what trends are reliable as there isn't a single area which is defined as overbought/oversold in MACD. This can be overcome by using previous peaks on the MACD in order to use them as areas of resistance and support. Since it's best utilized in trending environments The MACD will produce many false signals in opposition to the trend.

Stochastic For Trading Divergence

Stochastic functions as a momentum technical indicator by comparing its closing price to an average over the past 14 time periods. The stochastic indicator is more sensitive, which means it offers greater trading opportunities as well as divergence signals. However, this means it is able to provide more false signals. View the best best trading platform for website tips including robinhood crypto app uk, can you buy crypto on cash app, crypto app template, best crypto app for xrp, cryptocurrency app design, pi bitcoin app, 8 crypto, 0 brokerage crypto trading app, paxful bitcoin app, crypto app 2fa not working, and more.

How Do You Confirm Divergence?

Yes, but it is not always the case! Remember that indicators are used to filter price actions. The filter can allow us to identify what's important or overlook what's crucial in the context of the trading setup. The major advantage of using divergence as a trading signal for timing a trade entry is that it provides an indication before the price trend has changed. This signal comes before the market has changed and provides traders with a lower entry cost. There are a few disadvantages the use of divergence as a trading technique. It can produce false signals. This is where the indicator's direction changes but the trend of the price doesn't reverse, like the name suggests. This can happen when the indicator is overbought or oversold. While the pace of the trend could slow but it won't stop.

How Can You Determine If Divergence Is Present?

There are numerous proven strategies to lower the chance of losing trades and increase the probability of making money from trades. Avoid taking divergence signals that aren't in accordance with the trend of the long-term. If you prefer, you can go for the rangebound sideways. In the case of a bear market, you should only take signals that are bearish on RSI. In a bull market, however it is best to only accept signals to buy from RSI. Watch for the candle to confirm the divergence signal to close. Indicators will give signals based on the present status of the candle. The signals of divergence may disappear as quickly as they appear when the candle closes with a different outcome. Other indicators can be used to verify the signal. They include pivot points round numbers, pivot points and price action trading patterns. You can then choose RSI or MACD from the options. After the indicator is added to the chart, you can alter its settings. To take it off you need to click on the Arrow to change the indicator from active to none. Check out the top rated bot for crypto trading for blog examples including how to earn free bitcoin app, kraken crypto app review, cash app bitcoin scams 2022, download crypto app, cash app bitcoin fees 2021, crypto app for windows 10, crypto app vs coinbase, crypto app singapore, bitcoin app 360 ai tesla, crypto app builder, and more.

How Do You Confirm Divergence?

Yes, but it is not always the case! Remember that indicators are used to filter price actions. The filter can allow us to identify what's important or overlook what's crucial in the context of the trading setup. The major advantage of using divergence as a trading signal for timing a trade entry is that it provides an indication before the price trend has changed. This signal comes before the market has changed and provides traders with a lower entry cost. There are a few disadvantages the use of divergence as a trading technique. It can produce false signals. This is where the indicator's direction changes but the trend of the price doesn't reverse, like the name suggests. This can happen when the indicator is overbought or oversold. While the pace of the trend could slow but it won't stop.

How Can You Determine If Divergence Is Present?

There are numerous proven strategies to lower the chance of losing trades and increase the probability of making money from trades. Avoid taking divergence signals that aren't in accordance with the trend of the long-term. If you prefer, you can go for the rangebound sideways. In the case of a bear market, you should only take signals that are bearish on RSI. In a bull market, however it is best to only accept signals to buy from RSI. Watch for the candle to confirm the divergence signal to close. Indicators will give signals based on the present status of the candle. The signals of divergence may disappear as quickly as they appear when the candle closes with a different outcome. Other indicators can be used to verify the signal. They include pivot points round numbers, pivot points and price action trading patterns. You can then choose RSI or MACD from the options. After the indicator is added to the chart, you can alter its settings. To take it off you need to click on the Arrow to change the indicator from active to none. Check out the top rated bot for crypto trading for blog examples including how to earn free bitcoin app, kraken crypto app review, cash app bitcoin scams 2022, download crypto app, cash app bitcoin fees 2021, crypto app for windows 10, crypto app vs coinbase, crypto app singapore, bitcoin app 360 ai tesla, crypto app builder, and more.